Here’s how to lower bills on your monthly home expenses, without going to extremes. I wrote a sister post to this article that’s all about saving money on your electric bill, so I won’t focus on energy savings here. Today, it’s all about other ways to lower bills by tweaking your routine and schedules. Read about saving $ on your electric bill here:

How to Lower Your Electric Bill (Without Going Crazy)

There are actually a ton of ways to minorly adjust your lifestyle and save money on regular expenses; I’m trying as many as possible this month in the name of research (and dollars). Here’s what to try and/or skip!

Reduce Energy Usage

Utility bills are a huge expense in the summer for those of us running air conditioning. That’s probably a non-negotiable. For other electronics, you can save a bundle on electricity by using your appliances during off-peak hours. I dove into this topic, with more tips and ideas, in a separate article here:

How to Lower Your Electric Bill (Without Going Crazy)

Trim the Food Budget

I’m not a frugal cook, crazy coupon lady, or even that great of a budgeter when it comes to food. I have all kinds of annoying dietary rules (health reasons) and I love when other people cook for me (i.e. restaurants). With that said, I’m still thrifty when possible. Here’s how to save money on food, if you can pull these off.

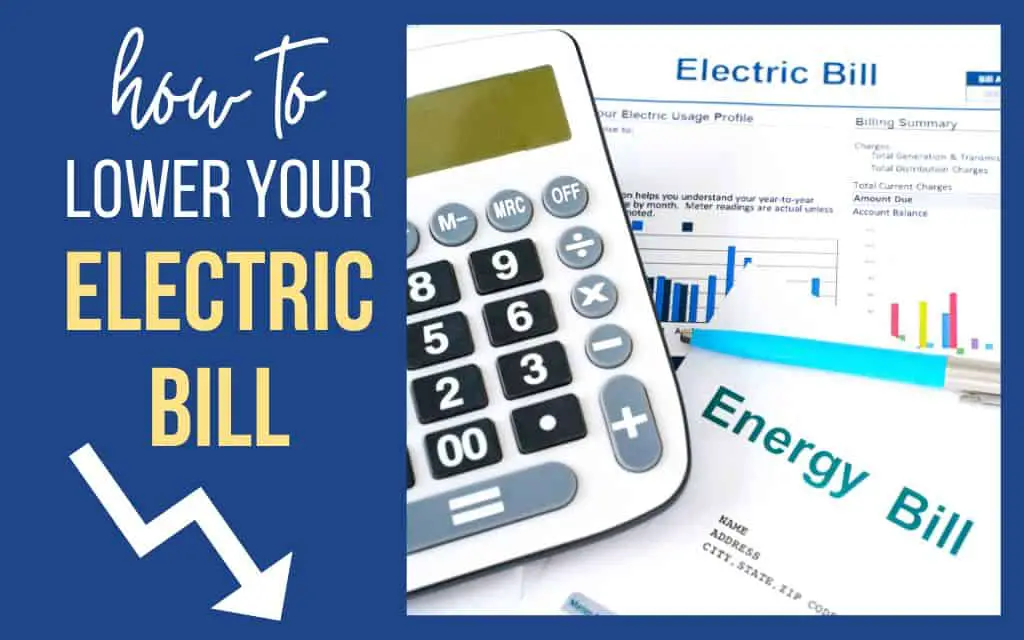

Try Meal Planning

Are you a meal planner? Groceries are a significant monthly cost for us, and I’m trying to get better at meal planning in order to save a little money. Last month, I created a meal-planning binder to organize our family favorites. Here’s the free Canva template if you feel inspired to try it:

Free Printable Meal-Planning Binder Template

Clean Out the Pantry and Freezer

One obvious way to cut costs is to intentionally use up as many of your pantry and frozen items as possible. Dig through your stash and plan 2+ meals each week that will use those on-hand items. Here’s a great list from Love & Lemons with 30 pantry recipes.

These are easy pantry meals to get you started:

- tuna noodle casserole (we still love this classic!)

- spaghetti with jar sauce + cheese

- lentil or bean soup

- chili

- charcuterie board (with whatever you have on hand)

Eat More Veggies

It’s often cheaper to eat vegetarian or vegan rather than meat-based dishes. Not all vegetarian meals are cheap, but pasta and soup usually are.

These are some of our favorites:

- Ina Garten’s Broccoli and Bow Ties

- Wild Rice Soup with Coconut Milk

- Quinoa, Corn, and Mint Salad

- Pesto Pasta (with cherry tomatoes)

- Mediterranean Chickpea Salad

Stick to a Restaurant Budget

Set a goal number for your restaurant meals each week. It’s easier to stick to a budget when you keep the max number in mind throughout the week. If you just look back and hope for the best, you’ll probably run over your limit.

During sports seasons, it goes up a bit for us because it’s hard to juggle schedules and eat at home – but we can try! My friend is really good about packing dinner for baseball games and I’m hoping to try that, too. Or at least, setting the crockpot on simmer for later.

Cancel Food/Meal Subscriptions*

*If these aren’t critical to your routine/schedule/sanity

Hear me out.

Meal delivery services are fabulous. I love them, too. But I can’t see how they save anyone money unless you happen to cook fantastically expensive meals on your own. Save them for the occasional splurge week and recipe inspiration, and you’ll also save money in the long run.

I’ve investigated a few subscription-based grocery services that claim to cost less than a traditional grocery store. While fun and streamlined, they are no cheaper than saavy shopping at my local stores – and I live in Boulder, an expensive college town!

Imperfect Foods – this service advertises to me constantly. They sure have my number. I finally signed up (with a $20-off coupon) and prepared to order, only to be shocked at the prices! I love that they send local produce and deliver to my door, but I still can’t spend $3.50 on ginger root that I’ll use for one meal and then watch the rest shrivel up and die. Love the concept, but I’m saving my produce dollars for the farmer’s market.

Thrive Market – I ordered a few rounds of groceries from Thrive during my one-year free subscription period. They sell plenty of great foods but the pricing is comparable or more expensive than at my local stores. However, it’s a nice option if you can’t find these types of healthy foods at your grocery store.

You Might Also Like:

How to Lower Your Electric Bill (Without Going Crazy)

Save Energy + Cash With a Smart Thermostat

Amazon Insights: Is Prime Day Worth It?

Consider Changing Your Home and Auto Insurance

Big sigh, I know. Dealing with home and auto insurance is not a fun task, but it’s important. If you have a few hours to call around and get new quotes, you might find a reputable agency offering your coverages at a lower rate.

I need to renew our insurance this month, so I’m diligently trying to do my homework in this category. My fingers are crossed for lower premiums, but the cost of building supplies has gone up, so I’m not terribly optimistic.

Cancel Extra* Subscriptions

Why the asterisk? Because some subscriptions save money in the long run if you plan ahead. This is always on the list of extra expenses to cut when you’re saving money, but if your subscriptions aren’t wasted, keep ’em going. Plus, if you just prefer certain branded products, sometimes auto-ship subscriptions will save a few bucks.

These are my few auto-ship subscriptions:

- Chewy.com (dog food)

- Amazon (Persil Sensitive detergent)

- Grove Co (recycled trash bags, dishwasher detergent, lavender hand sanitizing wipes)

These are awesome and smell great:

Honestly, I need to reevaluate that Chewy subscription, but I started it with 30% discount, which was a deal at the time.

Also on this topic, I already mentioned meal and grocery subscriptions. Jump to that section if you skipped it. I still vote to cancel food subscriptions, to save money, unless they truly make your life easier in a way that justifies the cost.

Switch to a Cheaper Cell Phone Plan

Those monthly bills really add up. If you’re paying more than $30 per month for phone service, and you’re not locked into a multi-year contract, you have a lot of options to save some money! Have you looked into pre-paid cell service plans yet? That’s a great way to save cash on your cell service. I used to have T-Mobile pre-paid monthly service, until I got tired of their terrible customer service and faulty auto-pay. (Maybe it’s better now.)

A few years ago, I switched from T-Mobile to Visible, which runs on the Verizon network. It’s $25/month and offers unlimited talk, data, and text! If you already own your phone and live in an area with good Verizon coverage, I highly recommend Visible.

Plus, I just noticed Rakuten offers a $15 cash back credit at Visible (jump to the Rakuten explanation).

Earn Money When You’re Shopping

On the flip side of lowering bills for home expenses is saving money when you shop. We all have to buy items for our homes, meals, kids, travel, etc. Might as make purchases that will eventually kick back a bit of cash, right?

The key is to avoid overspending and only buy what you need, sometimes easier said than done. Here are a few easy options.

Choose a Credit Card With Rewards

Whether you prioritize cash back or travel credit, there’s probably a credit card for you. I like to earn straight cash back, so I use Discover. I’m not a financial blogger, so I recommend reading a few websites like this or that to choose a card that works best for you.

My two cents (haha): never choose a card with an annual fee and don’t carry a balance.

Use Rakuten for Purchases

Rakuten offers an easy way to save a little money on purchases. Essentially, it’s a cash-back service at no cost to you. I am not an affiliate and receive no kickbacks. I just happen to use this myself and recommend it.

It’s actually really handy and easy to use; you don’t even have to start at their site. The Rakuten browser extension prompts you to click the button for savings when you visit an affiliated website. If I had to remember to start at Rakuten or check in there first, I would never use it, but the auto-prompt system is great.

Here’s what it looks like when I visit a website that partners with Rakuten. For example, I just ordered new lunch boxes from L.L. Bean and should get 2% cash back through the program.

Try Receipt Hog

This app is new to me, but I’m giving it a spin. Receipt Hog is an app that will let you earn rewards and cash for uploaded receipts. Apparently, you can upload any receipt and earn rewards. Sounds pretty easy, so let me know if you use it and what you think.

Here’s my experience so far. Receipt Hog accepts receipts from the previous 2 weeks. I tried adding a bunch of receipts lying around and they were rejected. You can also link it to other accounts, like Amazon, your email, etc. Personally, I wasn’t comfortable sharing that much personal information with a random app, but that’s just me. Once you start to rack up receipts, you can play little games in the app to get bonuses. I think this will only be a few extra dollars a month, but I’ll report back.

What Not to Do – Right Now

Reducing a mortgage is usually the first piece of financial advice to lower bills. After all, debt is the enemy of saving money.

However, now is not a great time to refinance your mortgage, unless you have an insane interest rate and refinancing would actually be an improvement. Very few of us are in that boat right now. You’ll have to do the math and talk to a bank to see if this is worth considering.

You Might Also Like:

How to Lower Your Electric Bill (Without Going Crazy)

Save Energy + Cash With a Smart Thermostat

Amazon Insights: Is Prime Day Worth It?