Last week I explained why and how I got a real estate license. Here’s the scoop on why it works for me, and how the math can make it work for you. Read part 1 here.

Background: I’m a teacher by trade, but I recently earned a real estate license as an experimental step in our journey of buying, fixing up, and selling houses. If you’re thinking about getting a license, read last week’s post, and then come back here to find out the real cost of a license. Is it worth it for you, too?

What Does an Active Real Estate License Cost?

In Denver, it costs me about $2200 per year to maintain an active real estate license with an employing broker (required). That is before any commission fees I may receive from buying or selling a home.

I pay monthly or annual fees to these businesses:

– $60 per month ($720/year) – admin fee to my employing broker

– $28 per month ($336/year) – contract software (to access all state-approved real estate contracts and forms)

– $44 per month ($528/year) – access to the local MLS (to see all listings in the metro area)

– $590 annual Realtor dues to local and national associations (required by my broker)

Edited to add: Colorado real estate agents are also required to have Errors and Omissions Insurance, which covers potentially costly mistakes (accidental contract errors, etc.). I forgot to add this to the list because my broker covers the cost, but some agents pay for E&O insurance independently. It runs about $220-250 per year.

In addition, I am required to take continuing education courses in order to maintain my license. Some are offered for free through my brokerage or local Realtor association, and there are always online options, too. Meeting those requirements means I can renew an active license every three years. Honestly, this is one of few fields where you don’t need a college degree and can make a great living, once you’re established. That’s worth a mention.

So When is it Really Worth it?

At first glance, earning a real estate license for casual house flipping might seem extreme. In fact, I shouldn’t even use the word “flip” because we’ve owned each of our houses as a primary residence for at least two years. Flippers try to buy and sell within the shortest time span possible, to maximize profit. We just like the process of getting a deal on a house, fixing it up ourselves, and then selling for a nice profit. Being in control of that process from start to finish, with me as our agent, works for us because the profit exceeds the expenses. Even on a two-year house rotation!

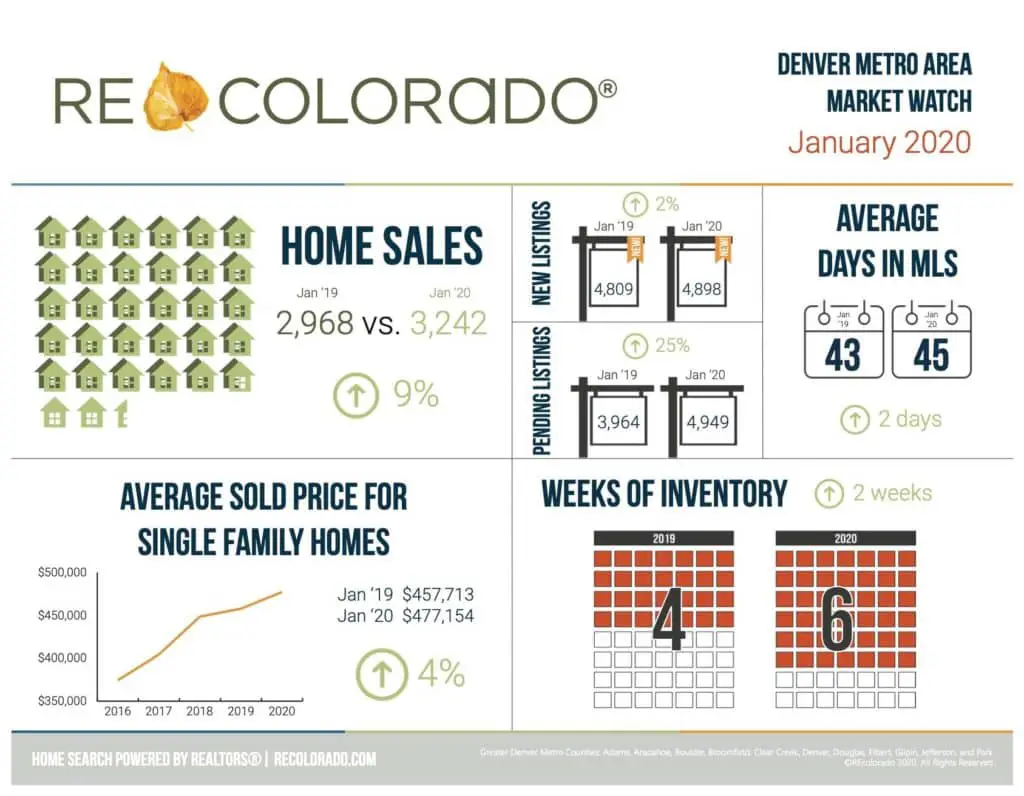

If you’re thinking about getting a real estate license for your own fixer uppers, I think it comes down to cost. The real estate market has been hot in Denver for at least the past 6 years, the entire time we’ve lived here. Here are some numbers for the Denver metro area in January, which is traditionally a slow market. The average closing price in January 2015 was $325,000 and by January 2020, it was $477,000. That’s a huge change in only 5 years! It’s now hard to find a single-family starter home in Denver for under $350,000.

While our city is definitely facing an affordability crunch, it makes selling real estate more lucrative. The typical commission rate in Denver is 2.8%, which is just the local customary rate, not set in stone. If we sell a house for $400,000, my commission would be $11,200. Can you see how the numbers make that worth my while? In our scenario, even if I only sell one house that we fix up every 2 years, it still more than covers the cost of maintaining my license. Added to that math, I actually LIKE the process of buying and selling our houses, so it all works!

What are the Other Options?

If getting a real estate license sounds unrealistic or impractical for you, what are the other avenues? Outside of hiring a traditional agent, there are some new business models attempting to break into the industry.

Redfin – This business has evolved over the years, and they are basically a budget brokerage now. They streamline the processes so you don’t work exclusively with one agent. Redfin offers a lower commission rate for sellers and approx $1500 toward closing costs for buyers. We’ve bought two homes with Redfin and been pleased with the process.

Trelora – A newer budget broker in the field is Trelora, with an intriguing business model. They offer to sell your home for a flat fee of $2500 and refund 50% of their commission if you buy with them. Selling for that rate seems like a no-brainer, but you’ll still need to pay the buyer’s agent (remember, sellers typically pay both agents). I also wonder how they are received in the industry as buyers’ agents (if they are stonewalled or ignored, that puts the buyer at a disadvantage).

Opendoor and Zillow – I’ve been hearing a ton of radio ads for Opendoor, which claims to send you a cash offer within 24 hours of your request. They base their offers on computer-generated comps, so if you’re just looking to unload your house in the fastest and easiest way, this might be it. If you’re selling the nicest home in the neighborhood, I think you’ll get more by listing your home in the MLS (either with a traditional agent or one of the discount brokerages above).

Questions, please!

Don’t forget to read part one of this series. CLICK HERE.

That’s the scoop. Would you be interested in learning anything else about real estate? Let me know! I found it hard to get real answers before traveling this path myself. Now I want to share what I’ve learned as a real estate insider. I would be happy to make this industry more transparent for others. Let me know if you have any questions!

Want to read more about our DIY home projects as we update our 1960’s ranch-style house? Try these posts:

How to Create Craftsman-Style Door Trim

Paint Like a Pro – Painting Tools and Tips

15 Affordable Entry Lights From Amazon